The US Industrial economy (if pipeline scheduling is correct) gave more ground last week, as both the Production Index and Consumption index retreated.

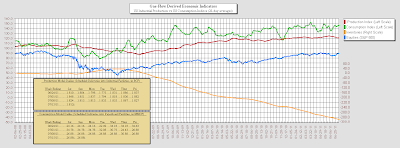

The US Industrial economy (if pipeline scheduling is correct) gave more ground last week, as both the Production Index and Consumption index retreated.The Production Index (In terms of its 28-day moving average of gas-flow scheduling into US industrial facilities) declined for its seventh week in a row, dropping to 119.5 (vs last weeks 120.2), and is at its lowest point now since 12/11/10. In its dailies, the measure was soft throughout the entire week, especially against seasonals.

The Consumption Index declined for its second week in a row, dropping to 143.4 (from last weeks 145.2). In its dailies the measure was firm most of the week, though it too was soft against seasonals.

The Inventories measure (the cumulative weekly difference between the Production Index and the Consumption Index) again continued in its long-term decline.

As was noted last week, the Production Index still looks as if it is wanting to lead into recession, with higher corporate profit margins and higher unemployment numbers both implied. This pattern is not typical of the historical modeling (2004-date). Food-group deliveries (now at bearishly high levels) suggest high anxiety amongst consumers in the economy in general, and the whole of the US economy appears very vulnerable to the downside should any negativity spook consumers.

And with political interests holding out the possibility of a governmental-default "Econo-geddon" in their posturing over debt/spending limits, opportunity abounds for negativity to suddenly start to snowball.

I personally find it very troubling that government-debt obligations have not been taken off the table (by the executive branch) by executive order to the Department of Treasury . It would be a small thing to do, as the entity is under the President who has the authority to guide on exactly what is subject to default, and holding the door open to default on US debt obligations for purposes of political posturing has to be the height of political foolishness.

I worry... US corporations under US law that miss debt payments can be forced into taken into bankruptcy. Could the US Federal Government be forced to go "Debtor-In-Possession"? US courts are open to all, and there is that little thing called the "Equal Protection Clause". The US supreme court could surprise if a default lands on their steps. I would not take that chance!

I saw posted elsewhere a suggestion that the public should elect less lawyers and more accountants to congress. Perhaps not such a bad idea...

-Robry825