Another lackluster week for the US Industrial economy last week (if pipeline scheduling is correct), while consumption held its ground and the US took a break over its traditional July-4th holiday period.

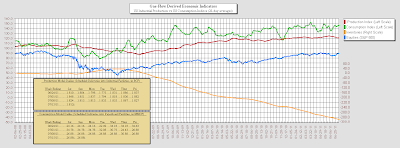

Another lackluster week for the US Industrial economy last week (if pipeline scheduling is correct), while consumption held its ground and the US took a break over its traditional July-4th holiday period.The Production Index (In terms of its 28-day moving average of gas-flow scheduling into US industrial facilities) declined for its fifth week in a row, dropping to 120.9 (vs last weeks 121.5). In its dailies, the measure was soft early (over the July-4th holiday period), firmed up a bit midweek, then softened again into the weekend.

The Consumption Index went the other way with a small gain, edging up to 146.0 (from last weeks 144.8). In its dailies the measure was soft throughout the week, with only a brief one-day firming on Thursday.

The Inventories measure (the cumulative weekly difference between the Production Index and the Consumption Index) again continued in its long-term decline.

Seasonally, the first couple weeks of July are historically soft (within the gas flows), presumably due to industrial retooling (especially in the automotive groups... which are themselves a significant part of the US industrial economy. We move out of the retooling period shortly, so we will be looking for signs of redirection (for better or for worse) the next couple weeks.

All the world seems to be waiting for the signal(s) the US government sends in the next couple weeks... with threatened government default only about three weeks away. Whether the signal is to advance the economy or kill it will depend solely on two negotiators at the table, but the markets, US consumers, US businesses, US investors, and a wide array of foreign interests will all be watching.

Best move (in my opinion) would be the a very slanted 90%-spending-cut / 10%-loophole-tax-increase... but only if combined with a very aggressive QE3 (too late for the half-strength QE3 I had thought of earlier).

(The Federal Reserve should definitely be at the bargaining table too... if not in the woodshed.)

-Robry825