The US Industrial economy advanced again last week (if pipeline scheduling is correct), as both industrial production and consumption advanced. The congressional "$40-a-week-payroll-tax-in-two-months" standoff-deal reached Thursday appeared to be poorly received within the gas flows.

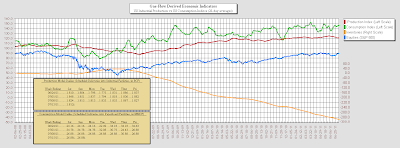

The US Industrial economy advanced again last week (if pipeline scheduling is correct), as both industrial production and consumption advanced. The congressional "$40-a-week-payroll-tax-in-two-months" standoff-deal reached Thursday appeared to be poorly received within the gas flows.The Production Index (In terms of its 28-day moving average of gas-flow scheduling into US industrial facilities) advanced for the 10th time in the last 11 weeks, rising to 124.0 (vs last weeks 123.5), its highest reading since June 6th, and closing in on its May 31st all-time high (124.8). In its raw dailies (above) the week started firm then softened late.

The Consumption Index had its second straight weekly gain, rising to 138.9 (from last weeks 136.9). In its dailies the measure started the week strong then sharply weakened midweek.

The Inventories measure (the cumulative weekly difference between the Production Index and the Consumption Index), continued its long-term decline.

The congressional payroll-tax deal appeared to give consumers pause, as Thursday's announced compromise seemed to coincide with a spat of scheduling-downticks within the gas-flows, and with all of the cross-currents of the wind-down of the Christmas-Shopping season, risk to the economy (and the markets) has to be assumed to be growing.

Friday Mornings batch of gas-flow data was so troubling it knocked me out and heavily into cash. Being an investor that relies solely upon personal trading for a living, I tend to play the cowards roll (can't afford a flat year) so I sometimes tend to be on the early side, and the markets should still have some good news in the pipeline (especially for the last week & the month of December) which hopefully will be somewhat supportive and give the consumer (and/or government) a chance to get back on track. Hopefully.

ROBRY VACATION NOTE: As it has been quite a while since our last vacation, we have decided to take a break and will be headed south for warmer climates for a break. While the reservations are not quite done with yet, I anticipate heading out by the weekend, so there will be a break in the economics posts for approx three weeks.

Regarding the early primaries (and considering that payroll-tax-blunder and weakening gas-flows) I suspect the anti-party sentiment gets pumped up from here. I still think a Ron Paul "ascendancy" has to be risked into ones investment/business outlook (whether you like him or not). Gut feeling is (unless economic & political patterns change) Ron Paul takes both Iowa and New Hampshire, then steamrolls (flattening everyone else) after that.

Republicans are looking for a "Ronald Reagan" (Outsider with apparent wisdom) and Reagan was often described as the "Teflon President" in his early years (in that "nothing would stick"). George Bush (Sr) remarked of Reagan's economic ideas as "Voodoo Economics" in the 1980 primaries (anyone remember those... hard to believe 32 years ago!). We had high unemployment back then too. Big-time political change often follows big-time unemployment.

Major political realignment within both political parties over the next three years to me appears likely. If Ron Paul is elected (which assumes further economic deterioration), gut feeling is major political upheaval follows in the Democratic Party (if it survives intact) in 2013-2014.

-Robry825